Is Playfina the Exemplary Solution for Managing Personal Finances? A Thorough Review

CASINOS | CASINO | BONUSES | NEW CASINOS | CRYPTO CASINOS | SLOTS | FREE SPINS

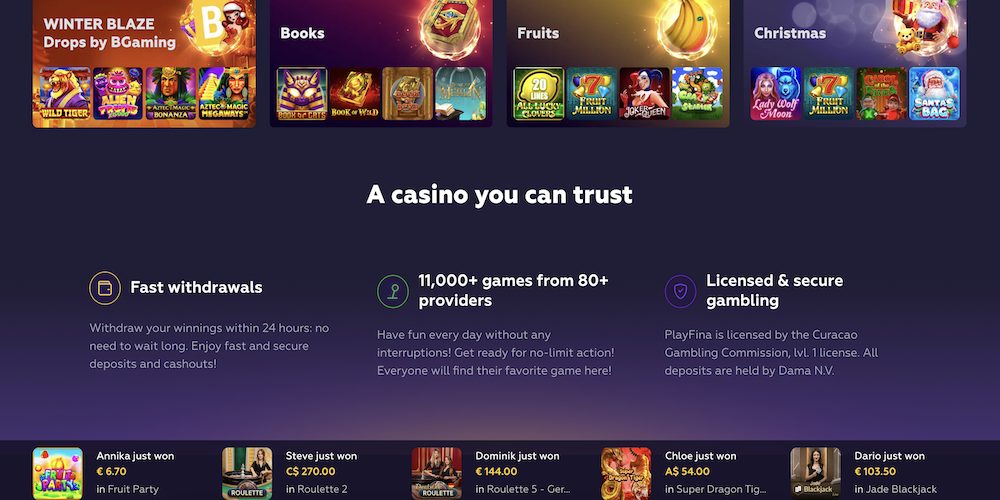

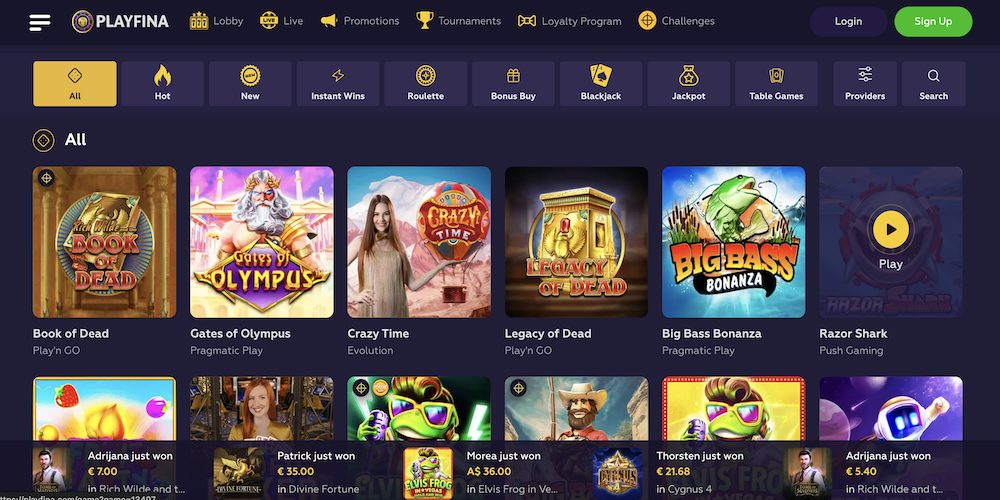

More than 11,000 slots, all varieties of blackjack, dozens of roulette games, craps, video poker, and other games are available to you at Playfina casino online Is Playfina the Exemplary Solution for Managing Personal Finances? A Thorough Review! Play the Best Online Casino Games at Playfina ✓ Try Slots, Blackjack, Roulette, Craps and Video Poker with Huge Bonuses. Playfina Casino How to Start Up to 1000€ + 200 FS + Secret Bonus... Playfina Casino - Bonus Codes – 50 Free Spins!

Casino Apps | No Deposit Casino | No Deposit Codes | Best No Deposit | Payment Methods | Real Money | Bonus Calculator

Have you ever wished for a guiding companion that could seamlessly navigate you through the labyrinthine landscape of personal finance?

An innovative solution has emerged on the horizon, promising to demystify the complexities of money management and revolutionize the way we interact with our financial affairs. Introducing Playfina – an enigmatic platform that has captured the attention of both seasoned finance gurus and curious beginners alike.

Playfina, or as some have dubbed it, the "Philosopher's Stone" of personal finance, breathes life into the often convoluted realm of money. It seamlessly blends technology, psychology, and strategy to empower individuals to take control of their financial well-being like never before.

With its arsenal of groundbreaking tools and features, Playfina aims to liberate users from the shackles of financial uncertainty, transforming them into informed and confident decision-makers. Beyond being a mere app, Playfina is an embodiment of empowerment, a virtual mentor that guides users towards financial freedom.

The Rise of Playfina: Revolutionizing Personal Finance

In today's rapidly evolving financial landscape, a new player has emerged that promises to disrupt and revolutionize the way we manage our money. Playfina, an innovative platform with its groundbreaking approach, is set to transform the world of personal finance. This article explores the rise of Playfina and its potential to reshape the way individuals handle their financial affairs.

With the ever-increasing complexity of managing personal finances, individuals are constantly seeking better tools and strategies to stay on top of their money matters. Playfina addresses this need by offering a fresh perspective and reimagining how we approach financial management.

Unlike traditional finance management platforms, Playfina takes a holistic and user-centric approach, empowering individuals to take control of their finances in a more engaging and intuitive manner. Through a variety of interactive features, users can track and analyze their spending habits, set savings goals, and gain valuable insights into their financial behavior.

The core philosophy of Playfina revolves around gamification, leveraging game-like elements to make personal finance enjoyable and motivating. By introducing challenges, milestones, and rewards, Playfina transforms what used to be a dull and tedious process into an exciting and rewarding journey.

The gamified nature of Playfina also fosters financial literacy and education among its users. Interactive quizzes, tutorials, and personalized recommendations help individuals develop a better understanding of various financial concepts, enabling them to make smarter and more informed decisions.

Elevating financial management to a new level

Engaging and user-centric approach

Transforming finance from mundane to exciting

Empowering users to take control of their money

Encouraging financial literacy through gamification

All in all, Playfina is poised to revolutionize personal finance, offering a refreshing and innovative solution that captures the attention of individuals seeking a more engaging and effective way to manage their money. As this platform continues to grow and evolve, it holds the potential to reshape the financial landscape and empower individuals to achieve their financial goals with ease and enjoyment.

Understanding Playfina: Features and Functionality Explained

Unlocking the true potential of Playfina involves delving into its extensive range of features and functionalities that sets it apart from traditional personal finance management tools. In this section, we will explore the various aspects of Playfina that make it a game-changer in the world of financial management.

First and foremost, Playfina offers a comprehensive set of tools to help users take control of their finances and achieve their financial goals. Whether it's budgeting, expense tracking, or goal setting, Playfina provides a user-friendly interface that simplifies the process of managing personal finances. Gone are the days of complex spreadsheets and tiresome calculations – Playfina automates these tasks, giving users more time to focus on what matters most.

Moreover, Playfina goes beyond basic financial management by incorporating advanced features that elevate the user experience. One such feature is the ability to synchronize bank accounts and credit cards, enabling real-time updates on balances, transactions, and spending patterns. This feature not only ensures accuracy and convenience but also enhances financial transparency, allowing users to make informed decisions about their money.

In addition, Playfina offers insightful financial analysis tools, empowering users to gain a deeper understanding of their spending habits and identify areas for improvement. Through personalized reports and visual representations, users can easily track their progress and make necessary adjustments to achieve their financial goals. Playfina truly revolutionizes the way individuals manage their money by providing valuable insights that were once exclusive to financial experts.

Furthermore, Playfina is not just limited to personal finance management – it also offers a range of innovative features that promote financial growth and savings. With its integration of promotional codes and offers, Playfina users can unlock exclusive discounts and deals on a variety of products and services. This added benefit not only maximizes savings but also incentivizes users to stay motivated and engaged in their financial journey. To take advantage of these Playfina promo codes and uncover massive savings, click here.

In conclusion, Playfina redefines the way individuals approach personal finance management through its wide-ranging features and functionalities. By simplifying financial tasks, providing real-time updates, offering insightful analysis, and promoting financial growth, Playfina has positioned itself as a leading player in the world of personal finance. Whether you are just starting your financial journey or looking to optimize your current financial situation, Playfina is the game-changer that can help you achieve financial success.

Benefits and Limitations of Playfina: A Closer Look

Examining the advantages and drawbacks of Playfina provides deeper insights into its potential for enhancing personal financial management. This section delves into the benefits and limitations of this innovative platform, exploring its ability to revolutionize the way individuals handle their finances.

One of the key benefits of Playfina lies in its capacity to streamline financial tasks and make them more efficient. By leveraging advanced technology and intuitive design, Playfina simplifies personal financial management, allowing users to easily track and monitor their income, expenses, and savings. This results in a comprehensive overview, granting individuals greater control over their financial well-being.

Another advantage of Playfina is its flexibility and adaptability to various financial situations. Whether users have diverse sources of income or complex budgeting needs, Playfina caters to individual circumstances. By offering customizable features, such as multiple account integration and goal setting, Playfina empowers users to tailor their financial management experience to their specific requirements.

However, it is important to acknowledge the limitations of Playfina. While the platform offers extensive tools and features, it may not be suitable for those seeking personalized and specialized financial advice. Playfina primarily focuses on automating financial tracking and planning, but it may lack the expertise and tailored guidance that individuals with complex financial situations desire.

Additionally, Playfina's reliance on technology may pose challenges for some users, especially those with limited access to internet connectivity or unfamiliarity with digital platforms. Although Playfina's user-friendly interface aims to simplify the financial management process, it is essential to consider potential accessibility barriers that may hinder certain individuals from fully benefiting from the platform.

In conclusion, Playfina offers significant benefits in terms of enhancing personal finance management through its efficiency and adaptability. Nevertheless, it is crucial to recognize the platform's limitations, particularly in terms of personalized financial guidance and potential accessibility concerns. By considering these aspects, individuals can make informed decisions about incorporating Playfina into their financial management strategies.

Discover the Best Playfina No Deposit Bonuses for Online Gambling here.

Playfina vs. Traditional Financial Tools: Which One Is Better?

When it comes to managing personal finances, individuals are faced with numerous options to help them track and control their money. Traditional financial tools have long been the norm, but with the emergence of innovative technology, new players like Playfina have entered the market, providing an alternative approach to personal finance management.

The Benefits of Traditional Financial Tools

Traditional financial tools, such as banks and budgeting apps, have been widely used for managing personal finances. These tools offer essential features like online banking, budget tracking, and bill payment reminders. They have a proven track record and are known for their stability, security, and established customer support.

The Advantages of Playfina

Playfina, on the other hand, presents a fresh approach to personal finance management. This new player in the market leverages gamification and interactive features to engage users in tracking and improving their financial health. By combining elements of gaming and finance, Playfina aims to make personal finance management more enjoyable and accessible to a wider audience.

One of the main benefits of Playfina is its intuitive user interface and user-friendly design. It offers visually appealing graphics, charts, and progress meters to help users understand their financial situation at a glance. Additionally, Playfina incorporates game-like features such as achievements, challenges, and rewards to motivate users to stay on top of their finances.

Another advantage of Playfina is its integration with various financial accounts and services. Users can link their bank accounts, investment portfolios, and credit cards to Playfina, allowing them to have a comprehensive overview of their financial activities in one place. This integration enables better financial planning and helps users make well-informed decisions based on their actual expenditure patterns.

Established and trusted

Innovative and engaging

Stability and security

User-friendly interface

Standard features

Game-like features and rewards

Limited integration

Comprehensive account and service integration

In conclusion, both traditional financial tools and Playfina offer unique advantages for managing personal finances. Traditional tools provide stability, security, and established features, while Playfina focuses on creating an engaging and user-friendly experience through gamification and comprehensive integration. Ultimately, the choice between the two depends on individual preferences and the desired level of interaction and enjoyment in personal finance management.

For players looking to enhance their financial wellness in a different context, Playfina Casino No Deposit Bonus Code: A Game-Changer for Players! provides an opportunity to explore financial strategies through the lens of online gaming.

Expert Opinion: Is Playfina the Future of Personal Finance?

In this section, we seek to explore the potential of Playfina in transforming the landscape of personal finance. Drawing upon the insights of industry experts, we examine the innovative features and functionalities offered by the platform and assess its ability to redefine the way individuals manage their finances.

With its disruptive approach to financial management, Playfina has garnered attention as a game-changing solution. As technology continues to advance, traditional methods of managing personal finances are being revolutionized. Playfina aims to empower individuals by providing them with a comprehensive toolkit to efficiently track, analyze, and optimize their financial health.

Playfina's visionary approach to personal finance management sets it apart from conventional methods. By leveraging cutting-edge technologies such as artificial intelligence and machine learning, Playfina is able to offer personalized insights and recommendations tailored to each user's unique financial situation. This level of customization allows individuals to make informed decisions and take control of their financial future.

The user-centric design and intuitive interface of Playfina make it accessible and user-friendly for individuals of all backgrounds. The platform simplifies complex financial concepts and provides users with clear visualizations of their financial data, enabling them to easily understand their financial standing and make better financial decisions.

Industry experts predict that Playfina has the potential to revolutionize personal finance management. With its focus on transparency, automation, and financial education, Playfina paves the way for a future where individuals have greater control over their financial well-being. By empowering users to develop healthier financial habits and achieve their long-term financial goals, Playfina may truly shape the future of personal finance.

What is Playfina?

Playfina is a personal finance management platform that aims to revolutionize how individuals handle their finances.

How does Playfina work?

Playfina utilizes advanced algorithms and artificial intelligence to analyze your financial data and provide customized recommendations and insights on managing your money.

Can Playfina help me create a budget?

Yes, Playfina offers budgeting features that allow you to set financial goals, track your spending, and receive notifications when you exceed your budget. It can help you in creating a well-structured budget.

Is Playfina secure?

Yes, Playfina takes user security seriously. It employs strict encryption measures and follows industry best practices to ensure the confidentiality and integrity of your financial information.

What sets Playfina apart from other personal finance management platforms?

Playfina stands out due to its user-friendly interface, advanced data analysis capabilities, and personalized recommendations. It focuses on gamifying the process of managing finances, making it engaging and enjoyable.

What is Playfina?

Playfina is a personal finance management platform that aims to revolutionize how people handle their finances. It offers various features and tools to help users track their expenses, set financial goals, and make better financial decisions.

To start playing your favorite games at Playfina, you must create a personal account. After that, you can access all the site's functionality Is Playfina the Exemplary Solution for Managing Personal Finances? A Thorough Review! Playfina Casino Review - No Deposit, Free Spins And Best Playfina Casino How to Start Up to 1000€ + 200 FS + Secret Bonus!!! You instantly get presented with the casino's primary services and listed games, as well as its live casino section...

Casino Apps | No Deposit Casino | No Deposit Codes | Best No Deposit | Payment Methods | Real Money | Bonus Calculator

2022-2024 @ Playfina: A Game-Changer in Personal Finance Management? Our Review